Working capital is defined as current assets minus current liabilities. For example, if a company has current assets of $90,000 and its current liabilities are $80,000, the company has working capital of $10,000. Regardless of a company’s size or industry sector, working capital is an important metric in assessing the long-term financial health of the business. Managing working capital effectively is a top priority for a part-time CFO to ensure adequate cash flow to meet its short-term commitments.

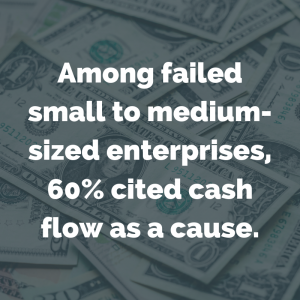

So, why happens if working capital is not managed efficiently? Your business can suffer from cash flow problems that significantly affect their ability to expand, improve processes or even operate their business. If your small business does not have a professional in charge of working capital, we highly recommend hiring part-time CFO services

Some of the factors that determine the amount of working capital needed include:

- Whether or not a company needs to have an inventory of goods

- How fast customers pay for goods or services

- How fast the company must pay its suppliers

- The company’s growth rate

- The company’s profitability

- The company’s ability to get financing

What Increases Working Capital?

Working Capital can be increased by the following:

- Profitable business operations

- Sale of long-term assets

- Long-term borrowings

- Investment by owners

In addition to increasing working capital, a company can improve its working capital by making certain that its current assets are converted to cash in a timely manner. For example, if a company can better manage its inventory and its accounts receivable, the company’s cash and liquidity will increase. This, in turn, improves the company’s working capital

What Decreases Working Capital?

The cause of the decrease in working capital could be a result of several different factors, including:

- Unprofitable business operations

- Purchasing long-term assets (without long-term financing)

- Repaying long-term debt

- Distributing cash to owners

Negative working capital is when the current liabilities exceed the current assets, and the working capital is negative. Working capital could be temporarily negative if the company had a large cash outlay as a result of a large purchase of products and services from its vendors.

Benefits of Positive Working Capital

- Improved Liquidity- By obtaining a consistently high level of working capital, organizations ensure that adequate cash levels are available for any potential upcoming opportunities or unanticipated scenarios. It also gives organizations more flexibility over how they run their operations which enables them to fulfill custom orders, expand and invest in new products at a faster rate.

- Operational Efficiency- Optimum use of working capital management evades any future hindrances in business operations. A ‘safety net’ is available to protect against lack of production or delays in payment of suppliers.

- Increased Profits- A high level of working capital is only achieved when areas including Accounts Payable and Receivable are operating efficiently. In order for both departments to operate in an efficient manner, they need to ensure that they pay their suppliers as per the agreed terms, which lead to the capturing of early payment discounts and increase the income of cash.

Achieving the Right Amount of Working Capital

In spite of the importance of consistently maintaining a high level of working capital, it is also important to understand that there is a level considered ‘too high’. Having an extremely high level on an on-going basis can indicate that there is more money within the organizations than is needed – that cash is not being invested correctly or company growth is being neglected in favor of high liquidity.

The key is to consistently maintain positive working capital, but avoid reaching too high a level that leads to waste and inefficiency. Before undertaking strategical changes to effectively manage your working capital, it’s worth having a part-time CFO take a look at some current working capital trends in order to see where mistakes and gains have already been made.

Final Thoughts

Managing working capital for your small business should be a top priority. It is essential to ensure your business can meet short-term commitments as well as strive for long-term growth and success. The key is to consistently maintain positive working capital, but avoid reaching too high a level that leads to waste and inefficiency. Part-time CFO services in Phoenix can help sure your small business is managing its working capital efficiently and effectively.

Grow Your Business With Working Capital Loans in Phoenix

Whether it’s expanding or improving your current business, investing in advertising, or tying-up existing “loose ends” like taxes or outstanding debt, the extra cash can be just the solution you need. National funding can get your business from $5,000 to $200,000 quickly with a minimum amount of paperwork.

- Fast and Secure Loan Approvals

- Professional and Personal Service

- NO Collateral Requirements

- The Lowest Borrowing Rates Guaranteed

Limitless Investment and Capital’s Part-Time CFO Services in Phoenix

When your company is looking to take the next step in its growth, a part-time CFO can provide financial and strategic guidance to achieve your goals. With a fresh set of eyes and a macro perspective on your business, Limitless Investment and Capital’s part-time CFO services drive meaningful results where you need them most on a budget that makes sense. Schedule a FREE Consultation with our team TODAY!